Embark on belajar trading forex gold a journey to become in the dynamic world of Forex analysis. This in-depth guide will equip you with the knowledge necessary to analyze market trends, recognize profitable opportunities, and reduce risk. From fundamental research to technical charting, we'll examine the key principles that will enhance your Forex trading performance.

- Cultivate a deep understanding of market factors.

- Master technical tools to forecast price movements.

- Execute risk management strategies to safeguard your capital.

Unlocking Fundamental Forex Analysis for Profitable Trading

Dabbling in the forex market can be a challenging endeavor. However, mastering basic analysis provides traders with a strong foundation for making intelligent decisions. By grasping key financial indicators such as GDP growth, inflation rates, and interest rate movements, traders can estimate currency trends. A deep knowledge of these factors allows you to discover profitable trading scenarios.

- Start your journey by studying reputable sources for financial data and news.

- Develop a comprehensive understanding of how worldwide events affect currency values.

- Continuously monitor market trends and adapt your trading strategies accordingly.

Technical Forex Analysis: Strategies and Tools for Success

Technical Forex analysis utilizes a diverse array of strategies to predict price movements in the foreign exchange market. Traders utilize these tools to pinpoint potential trading signals. Key among them are chart patterns, which reveal historical price movements. Technical indicators, such as moving averages and oscillators, deliver further insights into market sentiment. Understanding these tools and their applications is crucial for developing a consistent technical Forex trading strategy.

A robust technical analysis approach often includes a combination of fundamental evaluation and risk control. By integrating these elements, traders can make more calculated decisions and improve their chances of achievement in the dynamic Forex market.

Exploring Forex Technical Indicators

Technical indicators in the dynamic world of foreign exchange trading can seem like cryptic puzzles. Yet, understanding their purpose and application can empower traders to make more informed decisions. These mathematical tools analyze price action and trading volume, providing valuable insights into market movements.

Well-known indicators include moving averages, relative strength index (RSI), and Bollinger Bands, each offering a unique viewpoint on price action. By combining these indicators and observing their patterns, traders can recognize potential trading opportunities and mitigate risk effectively.

While technical indicators are powerful tools, it's crucial to remember that they shouldn't be used in isolation. Integrating them alongside fundamental analysis, market news, and sound risk management strategies is essential for consistent success in the forex landscape.

Turn a Savvy Forex Trader: Mastering Analytical Skills

The fluctuating realm of forex trading demands more than just gut feeling and impulsiveness. To succeed in this challenging market, you need to hone your analytical skills. A keen eye for patterns, coupled with the skill to interpret market indicators, is crucial for making informed trading decisions.

- Develop a method for spotting key factors that impact currency fluctuations.

- Leverage technical and fundamental analysis to gain comprehensive insights into market trends.

- Practice your decision-making skills by constantly reviewing your trades and adapting from both wins and losses.

By honing your analytical prowess, you can navigate the complexities of the forex market with certainty, increasing your chances of achieving consistent trading profits.

The Art of Forex Trading Analysis: From Theory to Practice

Forex trading analysis is a essential skill for consistent gains. It involves interpreting market data and identifying patterns that can predict future price actions. Successful forex traders utilize a combination of technical and fundamental analysis techniques to make calculated trading moves.

Technical analysis centers on past price data and graphical representations to recognize potential exit points. Fundamental analysis, on the other hand, considers financial factors that can impact currency values.

A comprehensive understanding of both technical and fundamental analysis is essential for building a effective forex trading strategy.

By honing their analytical skills and staying up-to-date with market trends, traders can maximize their chances of success their financial aspirations.

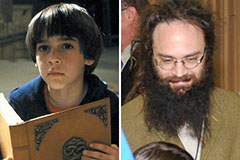

Taran Noah Smith Then & Now!

Taran Noah Smith Then & Now! Barret Oliver Then & Now!

Barret Oliver Then & Now! Michelle Pfeiffer Then & Now!

Michelle Pfeiffer Then & Now! Elin Nordegren Then & Now!

Elin Nordegren Then & Now! Rossy de Palma Then & Now!

Rossy de Palma Then & Now!